- Quicken versus moneydance for free#

- Quicken versus moneydance upgrade#

- Quicken versus moneydance software#

Setting up connectivity involves a few simple steps. Moneydance downloads data from most major and many minor financial institutions, meaning the transactions in your checking, savings, investment, loans, and credit card accounts. And the combination of multi-factor authentication and tokens whose access expires after a reasonable time (requiring re-authentication) adds to the security of your sensitive data. Moneydance never has access to your bank logins and passwords. Plaid makes its money by charging sites like Moneydance a fee for each customer-to-bank connection, not by selling your information to third parties or running ads that allow your online behavior to be tracked. To make bank connections possible, it has to store RSA public keys and encrypted access tokens. Moneydance only stores one piece of your personal information on its servers: your email address (and you can request to have it removed). The company takes a minimalist approach to data storage and encourages users concerned about security to read its privacy policy as well as Plaid’s. That’s now necessary for Moneydance+ subscribers since it’s working with Plaid for account aggregation, as so many other sites do too. For decades, the company has been able to keep its promise of not sharing data with third-party providers. Security and privacy are important to Moneydance. The old online banking service will still be available through banks that continue to support the open-standard OFX protocol, and will remain free. If you’ve already paid $49.99 for the software, you can subscribe to the new online banking service for $2 per month. For $5 per month, you get Moneydance+, which includes Moneydance itself as well as access to a new online banking system that uses Plaid (an account aggregation service that many personal finance sites use) instead of direct connections to financial institutions. The company now also has a subscription option. So if you buy Moneydance 2022, for example, you will also get the 2023 version when it comes out, as well as any minor upgrades.

Quicken versus moneydance upgrade#

For those reasons, we can’t recommend Moneydance as wholeheartedly as those personal finance services, but you may find it worthwhile for its many useful tools and presentations of your financial data.Ī license for Moneydance costs $49.99, which allows you to use the program for as long as you like, with one major upgrade included.

Quicken versus moneydance for free#

By contrast, Mint (the Editors' Choice pick for free personal finance services) bundles its features into top-notch web and mobile apps. That said, Moneydance lags behind Quicken Deluxe (the Editors' Choice pick for paid personal finance services) due to a dated, sometimes clunky user interface and substandard mobile apps.

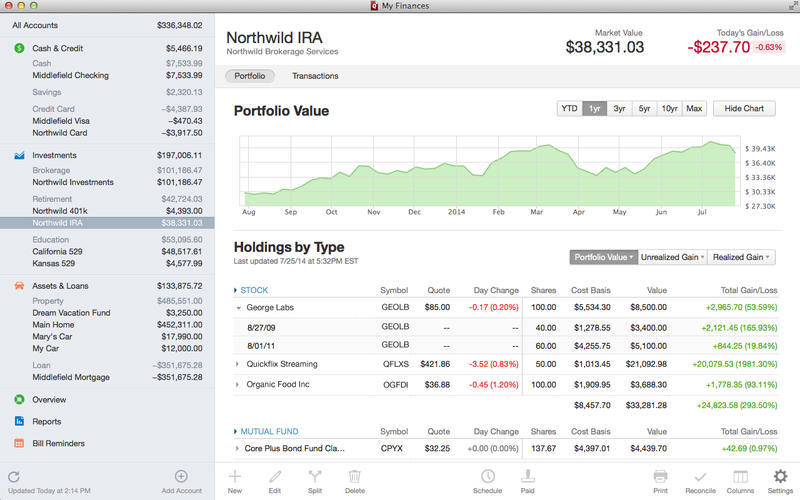

It also supports multiple international currencies and cryptocurrencies. This personal finance app offers much of the same functionality as Quicken Deluxe, including income and expense management, online banking and bill pay, investment tracking, budgeting, and reports. Today, Moneydance is no longer free or open-source, but it's available on all major platforms: Windows, Mac, Linux, iPhone, iPad, and Android. That makes Quicken and Moneydance two of the most mature personal finance apps on the market. One of those rivals was Moneydance, which launched as a free, open-source, desktop application a few years later.

Quicken versus moneydance software#

Personal finance software Quicken faced competition shortly after its 1991 launch.

0 kommentar(er)

0 kommentar(er)