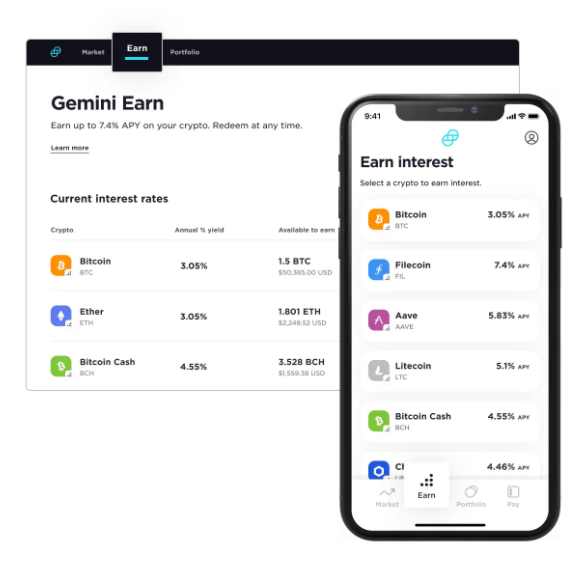

Gemini ended the Gemini Earn program earlier this month.

GEMINI EARN GENESIS HOW TO

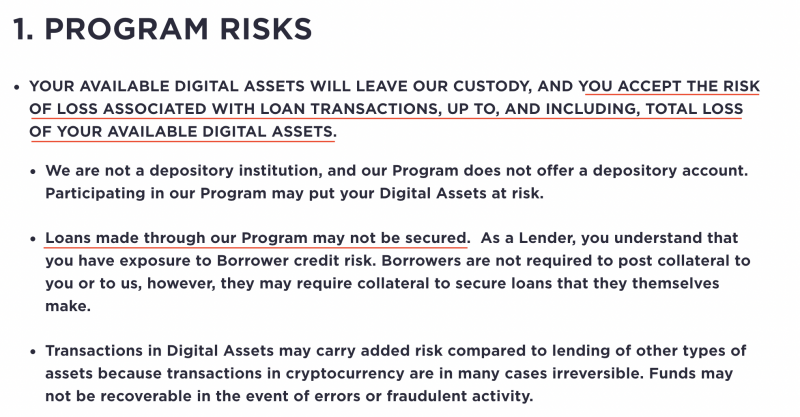

“Genesis then exercised its discretion in how to use investors’ crypto assets to generate revenue and pay interest to Gemini Earn investors,” the SEC said.īy November, however, Genesis announced it would not allow the Gemini Earn investors to withdraw their crypto assets because of a liquidity crunch following volatility in the crypto market after FTX’s bankruptcy filing, the SEC said.Īlso read: Gemini’s Cameron Winklevoss accuses crypto exec Barry Silbert of ‘bad faith’ stalling over frozen fundsĪt the time, Genesis held about $900 million in investor assets from 340,000 Gemini Earn investors, the SEC said.

Gemini deducted agent fees that were as high as 4.29%, the SEC alleges. retail investors, were to have an opportunity to loan their crypto assets to Genesis in exchange for Genesis’ promise to pay a high interest rate.

The Winklevoss twins were early champions of cryptocurrencies, using the money and fame they won in legal wrangling with Facebook parent Meta Platforms Inc.Īnd Meta’s founder Mark Zuckerberg over their role in creating the social-media giant to launch Gemini.Īccording to the SEC complaint, the Gemini Earn agreement between Genesis, part of a subsidiary of Digital Currency Group, and Gemini started in December 2020. The crypto exchange was sued late last year by investors alleging that the company sold interest-bearing accounts without registering them as securities, also through the Gemini Earn program.Īlso see: ‘Super lame,’ says Gemini co-founder Tyler Winklevoss about SEC charges

Twins Tyler and Cameron Winklevoss are the founders of Gemini. The SEC is also investigating whether other securities-law violations were committed and whether there are other companies or people relating to the alleged misconduct. The complaint seeks the return of any “ill-gotten gains” plus interest, and any civil penalties, the SEC said.

0 kommentar(er)

0 kommentar(er)